Oct 9, 2025

In Australia’s National Electricity Market (NEM), batteries submit 10 price–quantity bands to participate in the market’s 5-minute real-time intervals.

That used to follow a simple logic: forecast the prices, or use AEMO’s forecast, and stack your MW just below the price you are willing to sell, or just above what you are willing to buy. But, as we discussed in this post, batteries now increasingly set prices, particularly during peak hours. If all your available capacity is lumped in 1-2 price bands, you often risk shifting prices or not clearing your desired MW volumes.

At Powerline, we have demonstrated that strategic bid spreading—allocating slices of your available capacity across multiple bands—raises your chances of clearing in the intervals you intend to which helps in managing the battery’s state of charge, having more predictable market awards, and ultimately increasing revenue.

Quick refresher:

How bidding works in the NEM

Every dispatch interval (now 5-minute settlement), participants submit price–quantity offers across 10 price bands per unit for each market product, energy, and Frequency Control Ancillary Service (FCAS). Bands must be monotonically increasing and can be updated in the Day-Ahead, consistent with the market rules (Australian Energy Regulator (AER), AEMO). Bands remain fixed for real-time rebidding across the full trading day (4am to 4am), so setting the right price bands for the next day is an important step for market participants.

Spot prices for each market product clear every 5 minutes and are bounded by the Market Price Floor (MPF: –A$1,000/MWh), the Market Price Cap (MPC, set annually by the AEMC, currently A$20,300/MWh for FY26), and (on occasion) an Administered Price Cap applies during sustained high-price events.

How are these bands used during rebidding?

Participants must submit their full physical availability every 5-minute interval during the real-time rebidding process, even if the participant is not intending to clear. In other words, participants can’t just signal 0 MW availability for convenience. Therefore, battery projects, which typically have a duration of only 2-4 hours, must strategically allocate MW volumes into the fixed daily bands to clear during desired intervals (e.g., discharging during high prices) and to avoid clearing during undesired intervals (e.g., discharging during low prices).

In the past, when batteries did not have much pricing power, with a good price forecast (and low price-sensitivity), you could bid volume just under the expected clearing price and get dispatched. If you wanted to stay out of the market, you parked volume in a higher Band, often at the price cap.

What changed: pricing power and market elasticity.

As coal retires and storage scales, batteries are increasingly marginal price setters. Your bid curve doesn’t just respond to price; it can shape it. In elastic intervals, participants can:

set the price at or near the bid price band

fail to clear volume entirely

clear only partial volumes

This raises the stakes for batteries, turning price-setting into a risk–opportunity trade-off: underpricing leaves revenue on the table, while well-calibrated bids capture meaningful upside. For example, allocating capacity into Bands that are too high will prevent clearing enough volume. But bidding in Bands too low could set the prices lower. The strongest results come from bids that keep both MW and $/MWh high enough to drive strong revenue.

Evidence from the field

Setting price bands

Merchant battery projects must do two things well:

Select a good set of price bands for the next trading day

Allocate capacity strategically across price bands when rebidding every 5 minutes during the trading day

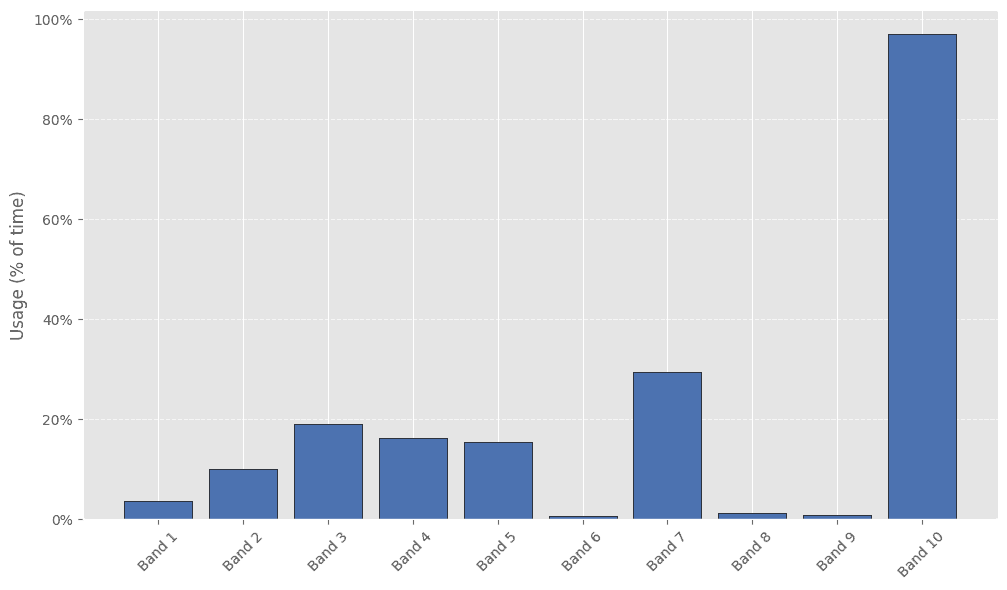

While we do observe many smart decisions across battery participants, there are opportunities to operate even more efficiently. For example, across multiple batteries we’ve analyzed, several Price Bands are under-utilized and rarely adjusted; classic “set-and-forget.” (See Band Utilization chart.)

*Band utilization represents the proportion of time intervals in which the band was allocated a non-zero volume.

In our next Powerline Insight, we will zoom into this subject and explore some practical strategies how to effectively set price bands.

Bidding allocation across price bands: “spreading”

Regarding allocation of capacity, we also see that many assets are using fairly simple bids where they allocate all capacity into only one of two price bands. When the market is sensitive to participant behavior, how you distribute MW across price bands materially changes both clearing success rates and realized prices.

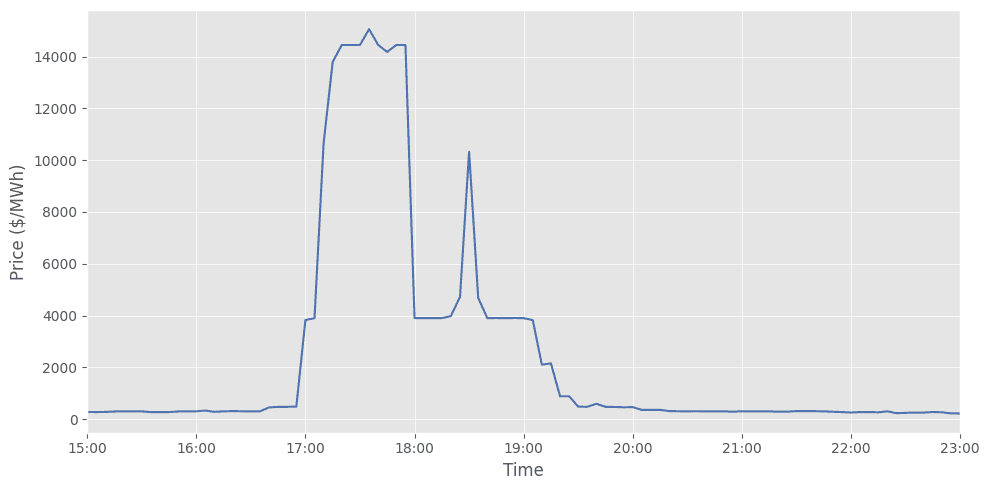

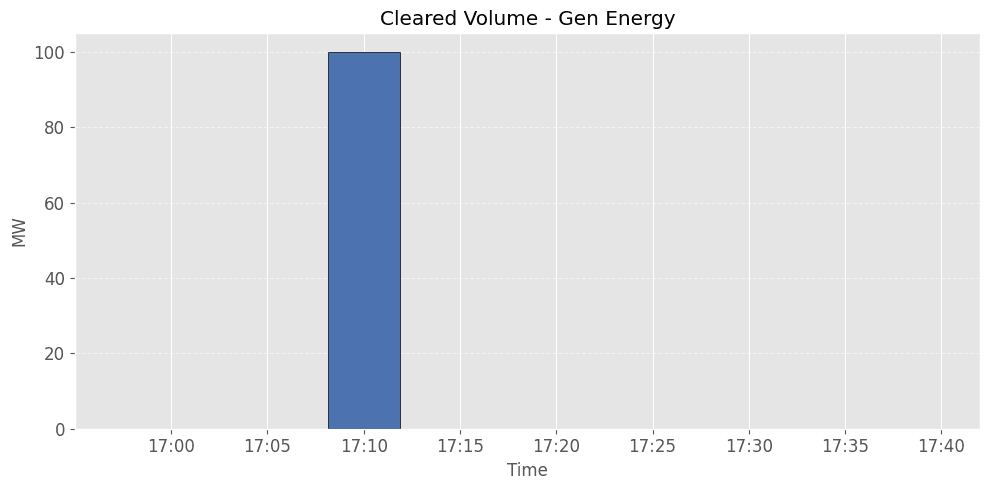

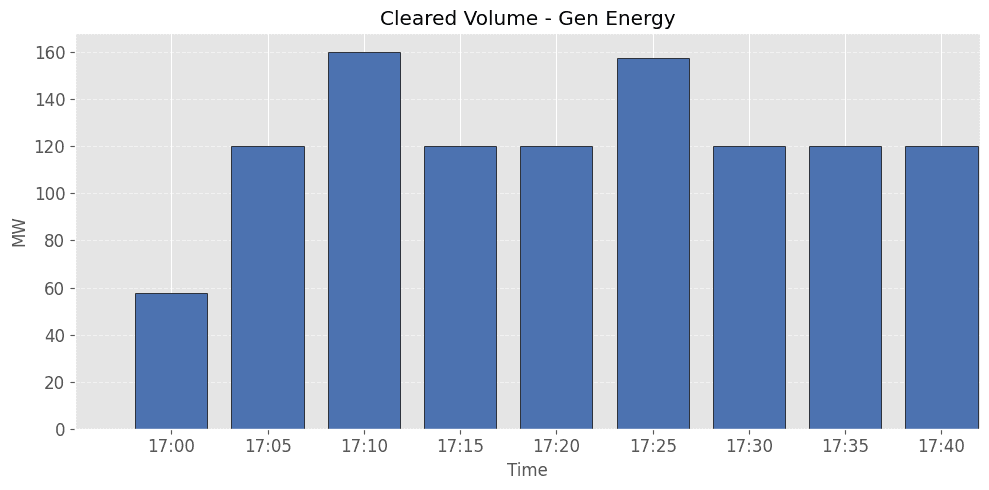

One example strategy is to bid into price band 10 (at the price cap) when the participant does not plan to discharge. In the example below, the battery fails to clear during several high-price intervals because the forecast did not anticipate the spikes. As a result, under this default bidding approach, the asset is not awarded any MW for the Gen Energy products when the price spikes but does not reach the price cap.

Market-clearing price

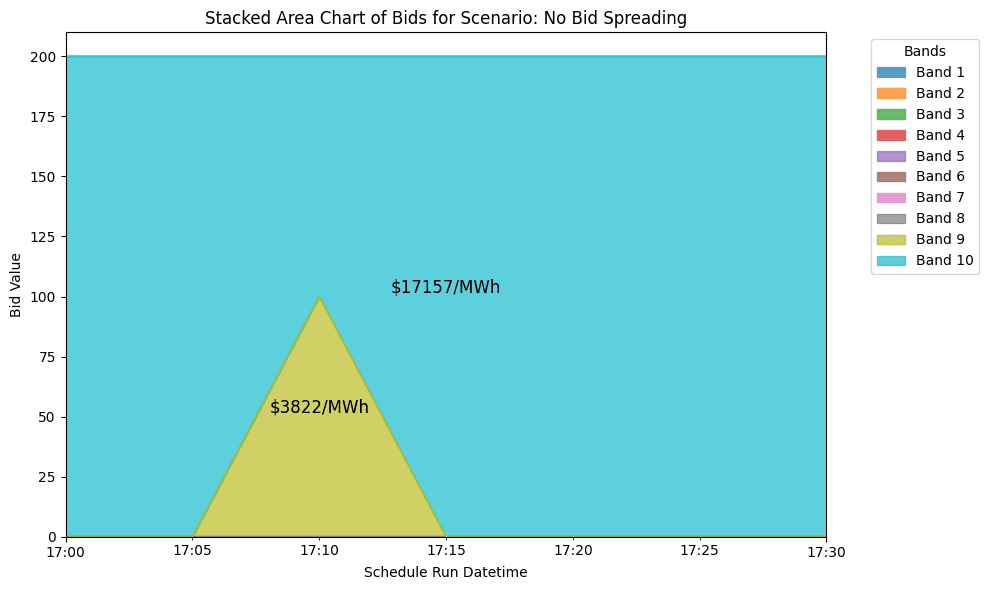

No Bid Spreading

With Bid Spreading

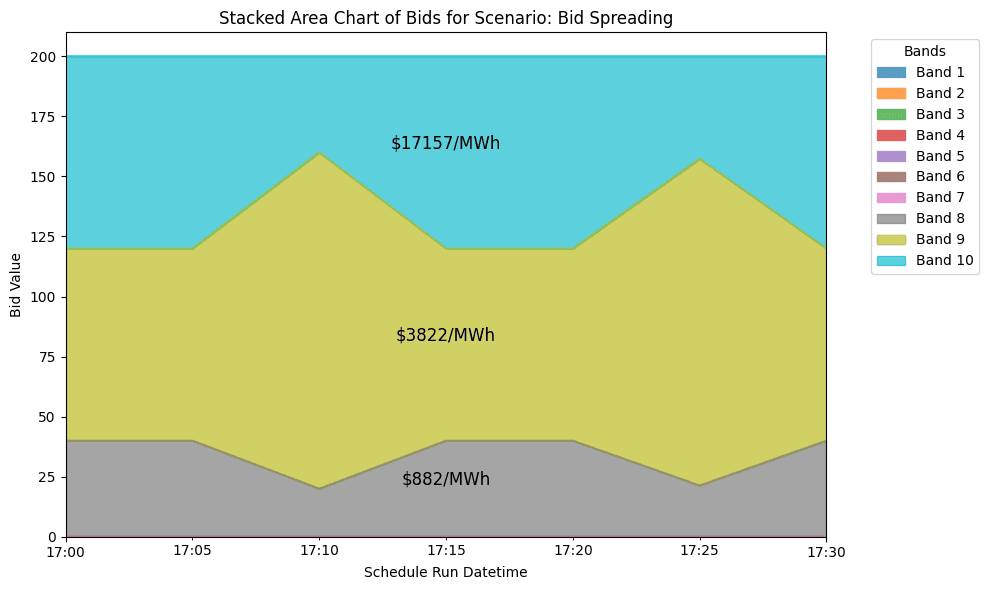

A better outcome could be to spread bids across multiple price bands to hedge against price forecast error and ensure clearing during more favorable prices. For example, Powerline’s Battery Co-Pilot™ was used to find the best bid spreading strategy for unscheduled MWs, for a 200MW/400MWh battery.

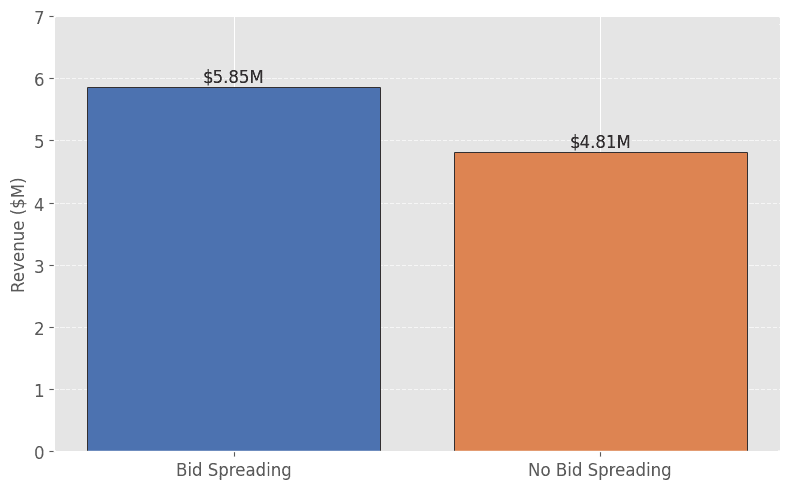

Instead of parking all unscheduled MW at PB10 (e.g., ~A$17k), we determined that spreading small slices across PB8 (~A$1k), PB9 (~A$4k), and PB10 would lead to additional $1.04M / month compared to “No Bid Spreading” strategy, which placed all capacity in PB10. This is a 22% uplift in revenue over the baseline strategy, coming purely from improved bid-curve construction.

Spreading boosted revenue efficiency, capturing 76% of the total available opportunity, up from 62% without spreading.

Why does Powerline’s strategy work?

With strategic bid spreading

You can partially clear on rising ramps without needing a full price spike

You limit your own price impact, avoiding self-defeating moves

You increase the odds of participating in transient spikes without sacrificing baseline performance

Total Battery revenue with and without default bid spreading for 5 Aug 2024

Why this is hard to do manually?

Optimal spreading depends on interval-by-interval market elasticity, local constraints, competing bids, and your own price impact. Getting that right requires:

· A high-fidelity market digital twin that reconstructs dispatch and clearing, not just a forecast

· A battery digital twin that reflects your constraints, contracts, and portfolio interactions

That’s exactly what we built. Powerline’s Market Clearing Engine models the full clearing process (at every 5-minute interval) and captures the feedback loop between your bids and market outcomes; our Battery Digital Twin turns that into actionable bid curves each interval.

Takeaways

In today’s NEM, bid shape is a first-order driver of returns.

Set-and-forget price band setting leaves money on the table, and can lead to large misses in revenue

Strategic bid spreading raises your market clearing success rate and revenue, particularly on volatile days.

Finding the right strategy at scale requires digital twins that model not just the battery’s bidding behavior, but also modeling the market clearing process in NEM.

Want to see how we can help you define winning strategies in NEM? Book a demo—we’ll run your units through Powerline’s Battery Co-Pilot and show the revenue delta potentials for your portfolio.